Ghana Card To Go Digital Next Year | General News

[ad_1]

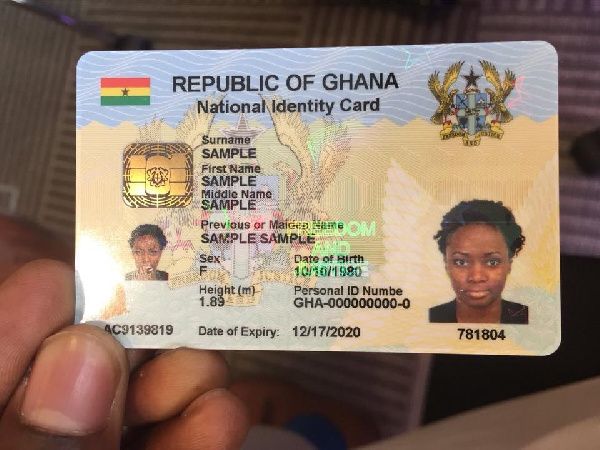

Chief Executive Officer of Margins ID Group, Moses K. Baiden has revealed that Ghana will next year launch a digital version of the universal national ID, Ghana Card, to complement the card.

He disclosed this in an interview with Techfocus24, a news site focused on tech news.

According to him, just like the e-passport profile on the Ghana Card, the electronic ID profile is also on the card already and will be activated next year.

Moses Baiden stressed, when the time comes, all information on the Ghana Card’s chip will be written onto the chip/SIM card in the owners mobile phone via an App, then a digital replica of the Ghana Card will be generated on the phone with a bar/QR code which can be read digitally for various purposes.

Because the Ghana Card uses a chip and all details can be written on it, the details can also be written on the chip of a phone so that where the physical Ghana Card is not available, the phone chip can be used to verify a person’s identity with a “near-field communication” device also designed and developed by Margins.

“We will also have a digital ID Card which looks just like your original Ghana Card with your picture, card number, date of birth and everything else plus a bar/QR code which can be scanned from your phone screen for all purposes”, he added.

Indeed, Kenya recently announced it is embarking on a project to provide citizens with digital ID cards but no physical ID cards; Moses Baiden, however, thinks it is not a good idea for particularly a developing country where such a system does not cover all-use cases and also limits its benefits to citizens.

He explained that whereas the digital version of the Ghana Card is like the actual card and equally efficient, when the holder’s phone dies, the digital version cannot be accessed for verifications.

Again, the physical card is necessary because not everyone has a phone and the infrastructure to read the digital ID is also not available everywhere yet.

Because mobile phone penetration is significant, the digital ID can be a good addition to the physical Ghana Card but “we are not yet at the stage where we can discard the physical card and go completely digital”, Moses Baiden further said.

But he insisted that, for convenience, it is important to have both so that in case one forgets to pick his physical ID card or loses it, the digital one can be used for all purposes.

Ghana Card for payments

Moses Baiden also mentioned that in spite of the several sarcastic jokes that have been made about the Ghana Card being used for payments, there is actually a payment application on the Ghana Card which can be used for financial transactions when activated.

He explained that there are 18 segments on the Ghana Card including a debit application, asserting “all we need is the legislation and the funds to activate all of them so Ghanaians can see, experience and fully benefit from the power of the Ghana Card”.

According to him, activating all 18 segments is expensive and by law, Margins is supposed to pre-finance it and prove it works before they will be paid by government, so it will take time for everything to be activated.

Pre-Financing by Margins

Expounding on the pre-financing aspect, Moses Baiden said previously when the law made it the responsibility of a State institution to design and develop the national ID, it took millions of dollars over a 12-year period to issue 900000 cards which were not issued instantly and did not even have all the features of the current Ghana Card.

During that period, the ID system designer was a French multinational with Margins only working as a sub-contractor providing and printing cards.

This, he noted, raised issues of sovereignty and national security as a foreign entity was in charge of the country’s ID system.

“So, Margins came up with the idea that if you claim you can design and deliver an effective national ID system and cards, why don’t you the contractor find your own money and do it? When it becomes successful, you get paid. There was no point in paying contractors hundreds of millions of dollars to deliver an ID system that does not work”, he stated.

Moreover, Margins has always had the experience and the infrastructure to design and develop reliable ID systems and infrastructure with international standards, the first of its kind in West Africa, to be built and owned by Africans; according to Mr. Baiden.

Instant cards

Once the green light was given, Margins started by piloting with foreigners ID cards with a system designed to issue cards instantly at least 85% of the time, unlike the previous one where applicants were issued with cheats and were asked to come weeks later for their cards; many of which were not even issued with the cards at all.

Over the past 15 years, Margins has been pre-financing the Ghana Card and only gets paid after work is done and the company has solved the country’s 50-year-old problem by providing a reliable universal national ID card that promises to revolutionalize national development.

Now, with the investment and ingenuity of Margins Group, a locally-owned company, the National Identification Authority (NIA) is able to issue Ghana Cards to applicants 15 years and above instantly and for free.

So far, over 85% of Ghanaians have been issued with valid Ghana Cards.

$1.5 Billion Leakage Eliminated

Moses Baiden said by developing the Ghana Card, Margins has saved the State over $1.5 billion which was what over 20 State institutions spent collecting data from individuals who accessed services from them over the 15-year period without the Ghana Card.

“Now that the Ghana Card is here, State institutions do not have to use manual and expensive means of collecting individual data any longer. People can even go online and apply for services, authorize access to their details and the service will be delivered once the details are verified without the applicant having to physically visit the offices of that State institution”, he disclosed, adding “SSNIT is doing it. Some banks are also doing it and several other institutions are doing it”.

He however noted that there are a few human behaviour hurdles to cross where certain individuals and some institutions still require a physical appearance before services are delivered, noting it will take time but assured that this will all fade away.

Online/Offline Card Readers

Beyond developing the card, Margins has also developed NFC card readers that enable the ID details to be verified for all-use cases even in situations where there is no internet or electricity.

The card readers, which come in both table top and handheld versions, can read all profiles on the Ghana Card and also do biometric checks, both online or offline.

They have a unique National PKI to identify even terrorists and other anti-social characters.

Moses Baiden further state that policies and laws exist only to facilitate development for people but it takes a reliable ID system to know who the people are and what exactly their needs are so that development planning will be more precise and effective.

He further explained that an efficient ID system is also critical to people knowing and accessing their rights and privileges as well as fulfilling their duties and responsibilities to the State.

The Margins Group CEO believes the Ghana Card holds the master key to Ghana’s development ensuring no citizen or resident, irrespective of their status, is left behind.

Source: Peacefmonline.com/Ghana

| Disclaimer: Opinions expressed here are those of the writers and do not reflect those of Peacefmonline.com. Peacefmonline.com accepts no responsibility legal or otherwise for their accuracy of content. Please report any inappropriate content to us, and we will evaluate it as a matter of priority. |

Featured Video

[ad_2]

Source link

Leave a Reply