Fidelity Bank Wins Best ESG Bank Of The Year 2024 Award In Ghana | Banking/Finance

[ad_1]

Fidelity Bank Ghana, the largest privately-owned indigenous bank, has been named “Best ESG Bank of the Year 2024 in Ghana” by the Global Business and Finance Magazine Awards, solidifying its position as a leader in sustainable banking practices. This award recognizes Fidelity Bank’s exceptional commitment to Environmental, Social, and Governance (ESG) principles and its efforts to drive sustainable growth in Ghana’s financial sector.

The Global Business and Finance Magazine Awards honour organizations that have made significant contributions to the fields of business and finance. Fidelity Bank’s recognition underscores its comprehensive approach to sustainability, including an innovative Environmental and Social Risk Assessment (ESRA) process for all loans. This ensures that climate risks are considered in lending decisions, with 100% of businesses receiving loans required to have fire extinguishers at their operations.

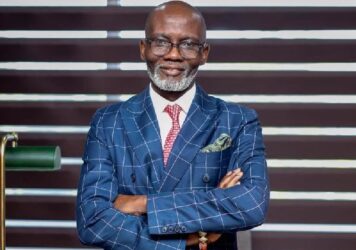

“We are honoured to receive the Best ESG Bank of the Year 2024 in Ghanaaward, which reaffirms our commitment to integrating sustainability into our business model,” said Julian Opuni, Managing Director of Fidelity Bank Ghana. “At Fidelity Bank, we believe in creating value not just for our shareholders but for society at large. This award reflects our continuous efforts to embed sustainable practices in everything we do—from responsible lending to waste management and climate action.”

Innovative Environmental Initiatives and Strong Commitments to Sustainability

A standout initiative is the bank’s ‘Waste to Cash’ program, which focuses on recycling paper and plastic waste, significantly reducing waste output while exploring new revenue streams. In the first half of 2024 alone, the bank recycled an estimated 2.8 tonnes of paper generated from its daily operations. This initiative is part of Fidelity Bank’s larger sustainability strategy, which includes developing a stand-alone climate strategy aligned with Ghana’s National Determined Contributions (NDCs) policy targets to reduce greenhouse gas emissions by 45% below business-as-usual levels by 2030.

“Our Waste to Cash program is a testament to our dedication to environmental stewardship,” Mr. Opuni stated. “By reducing waste and exploring innovative recycling methods, we are actively contributing to Ghana’s environmental sustainability goals and setting a benchmark in the banking industry.”

Pioneering the Future of Agriculture with GreenTech Innovation Challenge (GTIC)

In August 2024, during its annual Sustainability Conference, Fidelity Bank concluded its inaugural GreenTech Innovation Challenge (GTIC) with outstanding impact, awarding over GHS 1.4 million in grants to 17 groundbreaking businesses that address key challenges in the agriculture sector using technology. Launched earlier this year in partnership with Innohub, the GTIC aimed to empower young entrepreneurs across various business cycles, including ideation, scale-up, and commercialization stages. This initiative supports the development of sustainable solutions for Ghana’s agricultural industry and reinforces Fidelity Bank’s commitment to fostering innovation and sustainable practices across diverse sectors.

Recognition for Corporate Social Responsibility and SME Support

Additionally, Fidelity Bank was also named “Best CSR Bank Ghana” by Global Business and Finance Magazine, and Best CSR Bank Ghana by the Global Banking & Finance Awards, highlighting its impactful corporate social responsibility efforts. The bank’s Orange Impact initiative, launched in 2022, supports 15 schools over five years with classroom construction, refurbishments, and learning materials. To date, seven schools have benefited, with Accra Royal JHS being the most recent addition.

Furthermore, the bank’s tailored support for small and medium-sized enterprises (SMEs) earned it the “Best SME Bank” title. In the first half of 2024, Fidelity Bank empowered 103 SMEs across sectors like manufacturing, agriculture, creative arts, WASH, and technology through initiatives like the Fidelity Young Entrepreneurship Fund and Orange Corners. These programs provide funding, technical assistance, and mentorship to young entrepreneurs, especially women aged 18-45.

Impactful Partnerships and Diversity Initiatives

In other news, Fidelity Bank was also named the Best Bank for Diversity and Inclusion by the Euromoney Awards, recognizing its focus on economic empowerment for disabled people, gender equity, and opportunities for disadvantaged youth. Through its partnership with the International Fund for Agricultural Development (IFAD), the bank has reached over 15,000 people with remittance and financial inclusion programs and mobilising over GH¢65million in savings.

“Our recognition as the Best Bank for Diversity and Inclusion is particularly meaningful to us,” added Opuni. “Our focus on supporting disabled entrepreneurs, gender equity, and empowering young girls to pursue careers in male-dominated fields is central to our mission of fostering an inclusive and equitable society.”

Future Commitments to Sustainable Growth

Fidelity Bank remains dedicated to driving sustainable growth and social impact through innovative programs, robust climate strategies, and impactful partnerships. “As we celebrate these achievements, we are inspired to continue pushing the boundaries of what it means to be a sustainable and inclusive bank,” concluded Mr. Opuni. “We call on other like-minded organizations to join us in this journey toward a more sustainable and equitable future.”

Source: Peacefmonline.com

| Disclaimer: Opinions expressed here are those of the writers and do not reflect those of Peacefmonline.com. Peacefmonline.com accepts no responsibility legal or otherwise for their accuracy of content. Please report any inappropriate content to us, and we will evaluate it as a matter of priority. |

Featured Video

[ad_2]

Source link

Leave a Reply