ZeePay And Moneygram Launch Account Deposit Service In Nigeria | Business News

[ad_1]

Zeepay, Africa’s fastest-growing cross-border fintech, and MoneyGram International, Inc. (MoneyGram), a leading global financial technology company that connects the world’s communities, today announced the launch of a pioneering Account Deposit service for consumers in Nigeria.

This innovative service, a first in the Nigerian market, enables remittance receivers to directly transfer funds into bank accounts from just about every country in the world.

In this landmark partnership, Zeepay and MoneyGram introduce a service that revolutionizes the remittance experience in Nigeria. As consumer preference shifts online, beneficiaries can now conveniently and securely receive funds directly into their bank accounts.

This service provides consumers with several options to receive remittances, as funds are readily accessible through various channels, including ATMs, point-of-sale devices and bank counters.

MoneyGram’s vast global network, spanning over 200 countries and territories and serving over 50 million people annually, complements Zeepay’s dominant position in cross-border payments across Africa, extending even to the Caribbean.

According to a recent report by the World Bank1, Nigeria was the second largest recipient of remittances in Africa, and remittances are being sent to the country to help alleviate food insecurity, supply chain disruptions, aftermath of floods and other natural disasters, and more.

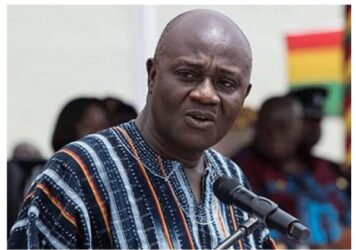

Dede Quarshie, Commercial Head at Zeepay, comments, “We are thrilled to introduce this innovative service to consumers in Nigeria, a market that truly relies on inbound remittances. This launch is a significant step in improving last-mile access and addressing security concerns for remittance receivers. With our account deposit service, beneficiaries in Nigeria can now access their funds around the clock, whether through ATMs, point-of-sale devices, or counter services.” The service is now live and available for consumer use in Nigeria.

Source: Peacefmonline.com

| Disclaimer: Opinions expressed here are those of the writers and do not reflect those of Peacefmonline.com. Peacefmonline.com accepts no responsibility legal or otherwise for their accuracy of content. Please report any inappropriate content to us, and we will evaluate it as a matter of priority. |

Featured Video

[ad_2]

Source link

Leave a Reply