BoG Projects Sustained Rebound In 2024 | Banking/Finance

[ad_1]

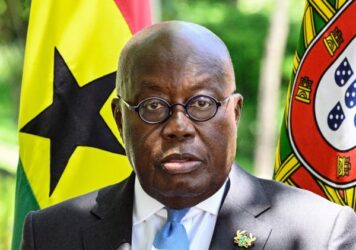

The Bank of Ghana (BoG) Governor, Dr. Ernest Addison, delivered an optimistic outlook on the nation’s economic recovery – stating that barring any unanticipated shocks, the signs of a gradual and consistent rebound in the economy will take shape from next year.

According to him, recent macroeconomic indicators have provided positive signals – attributing the turnaround to sound macroeconomic policies, successful domestic debt restructuring and a series of structural reforms

“Let me assure you that the economy is on a gradual rebound. Growth is improving steadily, inflation is declining and the fiscal and external positions are improving, alongside relative stability in the exchange rate. Absent unanticipated shocks in the outlook, the continued implementation of prudent policies will further strengthen the recovery process and reinforce the disinflationary process,” he explained during his speech at the 2023 Governors Day Annual Bankers’ Dinner hosted by the Chartered Institute of Bankers (CIB).

The central bank chief attributed this anticipated recovery to the implementation of some policies, specifically pointing out impacts of the Bank’s Domestic Gold Purchase Programme (DGPP) launched in June 2021.

The Governor said the DGPP’s first leg, known as Gold for Reserves (G4R), exceeded expectations. The bank purchased 17.89 tonnes of gold, equivalent to US$1.14billion – doubling the central bank’s gold reserves well ahead of the initial target.

Additionally, the Gold for Oil (G4O) programme under DGPP contributed to a reduction in demand for US dollars by Bulk Oil Distribution Companies (BDCs) and positively influenced the Bank’s cashflow, maintaining stable ex-pump prices and supporting the local currency, he said.

As a result of these initiatives, the first half of 2023 saw gross domestic product (GDP) growth averaging 3.2 percent – surpassing earlier forecasts of 1.5 percent. Headline inflation, which peaked at 54.1 percent in December 2022, declined to 35.2 percent in October 2023; demonstrating the effectiveness of implemented policies, he noted.

Turning attention to the banking industry, Dr. Addison acknowledged the challenges faced in 2022 due to Domestic Debt Exchange Programme (DDEP)-related losses, primarily from significant holdings of Treasury bonds. However, official data at the end of October 2023 showed relative stability in the sector. Total assets increased by 16.7 percent year-on-year to GH¢257.89billion, funded by a 26.6 percent growth in deposits to GH¢199.94billion.

The profitability of banks remained robust, with an industry post-tax profit of GH¢7.10billion, representing a 60.4 percent annual growth. The capital adequacy ratio, adjusted for regulatory reliefs, stood at 13.4 percent in October 2023 – exceeding the revised prudential minimum of 10 percent. However, the industry’s Non-Performing Loans (NPL) ratio increased to 18.3 percent in October 2023 – attributed to elevated credit risk associated with the macroeconomic crisis in 2022.

Praise deserved?

The Governor once again took the opportunity to defend BoG’s role during the crisis, highlighting its critical support to the economy and the misunderstandings that have arisen.

He called for public appreciation of the Bank’s resilience, and emphasised the ongoing corrective actions and commitment to sound management, transparent accounting and good governance practices.

“It is very clear that only a central bank which has been prudently run, built buffers and is well-positioned can step in to support an economy from collapse. It is therefore most appropriate, I believe, to state that Ghanaians should rather applaud and commend the Bank of Ghana’s resilience,” he opined.

The Bank had come under intense criticism for its financing of government, which resulted in a record loss of some GH¢60.8billion last year. This led to negative equity at a colossal GH¢55.12billion, culminating in an organised protest against management of the central bank and calls for resignation of its leading figures.

Dr. Addison emphasised the necessity of policy choices made during the crisis for the economy’s greater good. He reiterated that the losses were primarily a result of the Bank’s role as ‘loss absorber’ during a period of economic crisis.

The 50 percent haircut on exposure to government, in the form of holding public debt securities and loans to state-owned institutions, led to GH¢53.1billion in impairment charges. This decision, while controversial, was framed by Dr. Addison as a necessary policy choice for the greater good of the economy as he further contextualised the Bank’s role during the crisis; highlighting that its strong policy buffers allowed it to support the economy until conclusion of the International Monetray Fund programme.

“The Bank played a critical role to support the economy during the crisis period with distinction. It is very clear the Bank’s role in supporting the economy through this crisis has not been fully understood, and in some cases deliberately misinterpreted. The bank came under severe attack across the media space, culminating in an organised demonstration against the institution,” the Governor narrated.

The central bank head also used the platform to call for unity and support, recognising the pivotal role played by the Bank of Ghana in steering the nation through challenging times.

“The bank will continue to closely monitor developments and, where need be, take appropriate and decisive actions to address same. Also, the bank will ensure that depositors’ funds remain safe and the financial system remains stable and resilient,” he affirmed.

Source: B&FT

| Disclaimer: Opinions expressed here are those of the writers and do not reflect those of Peacefmonline.com. Peacefmonline.com accepts no responsibility legal or otherwise for their accuracy of content. Please report any inappropriate content to us, and we will evaluate it as a matter of priority. |

Featured Video

[ad_2]

Source link

Leave a Reply